Tax Exempt Status

As a result of recent pending law changes regarding the requirement of collection of sales tax, AndyMark began collecting sales tax. AndyMark now collects sales tax in the following states: California, Florida, Illinois, Indiana, Michigan, Minnesota, New Jersey, Ohio, Texas, and Washington.

Unless you have a sales tax exemption certificate or direct pay permit uploaded to your account (and have received approval) you will be charged sales tax on all orders in those states.

If you would like to obtain tax exemption status on your AndyMark orders, please check with your school or company’s business office to obtain the correct sales tax exemption form for your state.

NOTE: A W-9 is NOT a sales tax exemption form.

HOW TO UPLOAD FORMS TO YOUR ACCOUNT

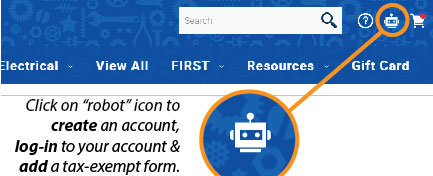

- Create an account on AndyMark.com, if you don’t already have one and/or log in to your account.

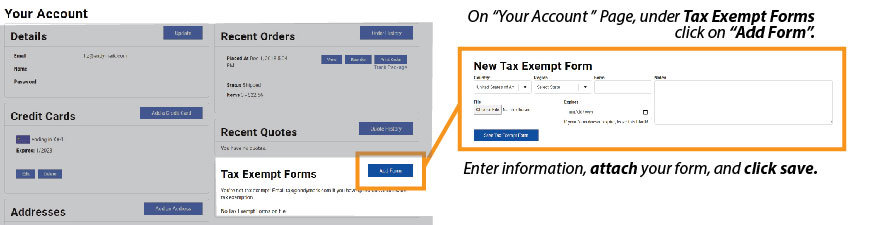

NOTE: Tax exemption will be tied to each individual customer account, so each individual who places orders for your entity must upload the exemption certificate to their individual account. - Upload your completed state tax exemption form, or direct pay permit, to your account. You can access your Account Menu by selecting the robot icon next to the shopping cart on the home page. Select Choose file and upload your form. .

APPROVAL PROCESS

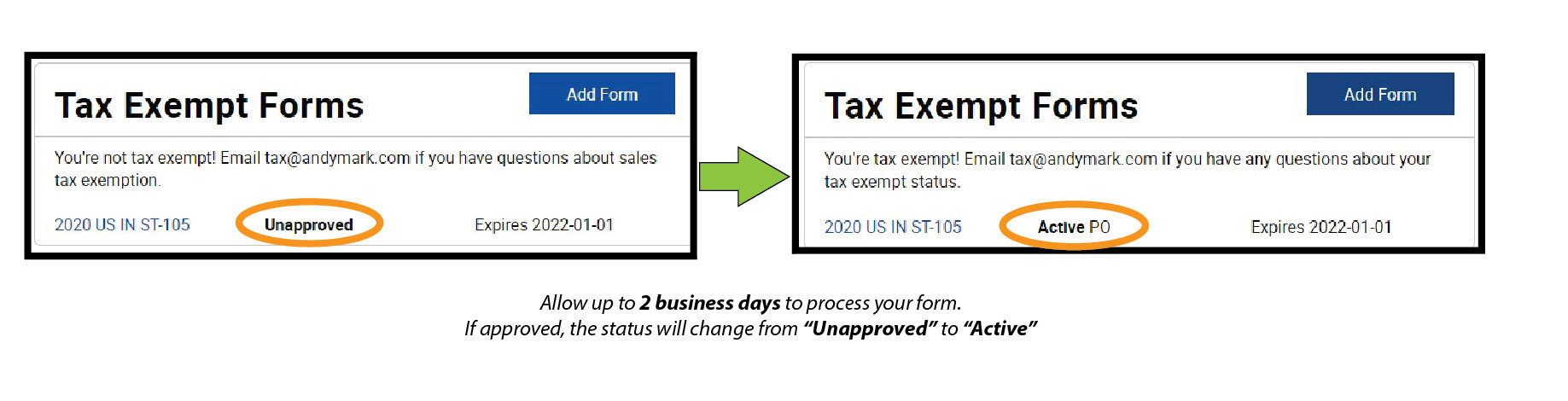

Please allow 2 business days for approval by our staff from the time your form is uploaded. Once approved, the status on "Your Account" page will change from "Unapproved" to "Active".

An email will be sent once your tax exempt status is approved and you can make purchases with your exempt status. If your form was denied, you will get an email with notes indicating the reason.

PLACING ORDERS - PAYMENT

NOTE: If you are not logged into your account when an order is placed, your tax exempt status will not be recognized and sales tax will be charged.

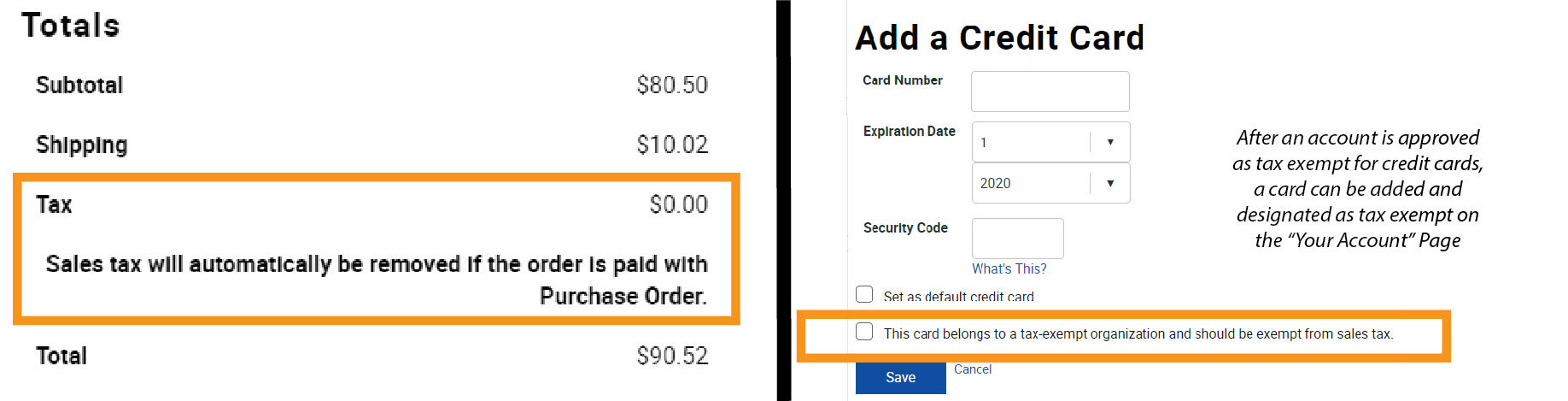

Once your Tax Exempt Status is Active, you will be able to place orders with tax automatically removed.

Some states require collecting sales tax with items purchased on a personal credit card, even if the items are for a tax exempt entity. It is important to make sure you are using a school/business issued card when placing orders if you are in one of these states.

CREDIT CARD PURCHASES

To make tax exempt purchases with a credit card, you will also need to add that credit card to your account and designate it as "Tax Exempt" in order to have taxes removed from your order. Please follow the steps below:

If you have a tax exempt credit card that is not currently listed on your account, you may add this card to your account on the "Your Account" page. When you are adding the card, there will be a check box option to indicate the credit card is a school or business issued tax exempt card.

Once added to your account, future orders placed using this card as a payment method will not be charged sales tax.